Call for help: 0415453721

Mail to us: info@alliancebrokerpro.com.au

In business, expenses don’t always align with revenue. A Business Line of Credit is the ultimate tool for smoothing out these bumps. Think of it as a “standby” facility or a robust business overdraft. Unlike a standard term loan where you receive a lump sum and immediately start paying interest on the whole amount, a line of credit gives you a pre-approved limit (e.g., $100,000) that sits ready for you to use.

You can draw down $5,000 to pay a supplier today, repay it next week, and then draw down $20,000 for stock next month. The critical advantage is efficiency: you only pay interest on the money you actually use, not the full limit. It is a revolving door of capital that remains open as long as you make your repayments, giving you total control over your working capital.

Smart business owners use a line of credit not just for emergencies, but as a strategic lever.

Pay for What You Use: If you have a $100k limit but only use $10k, you only pay interest on the $10k. It is the most cost-effective way to manage short-term needs.

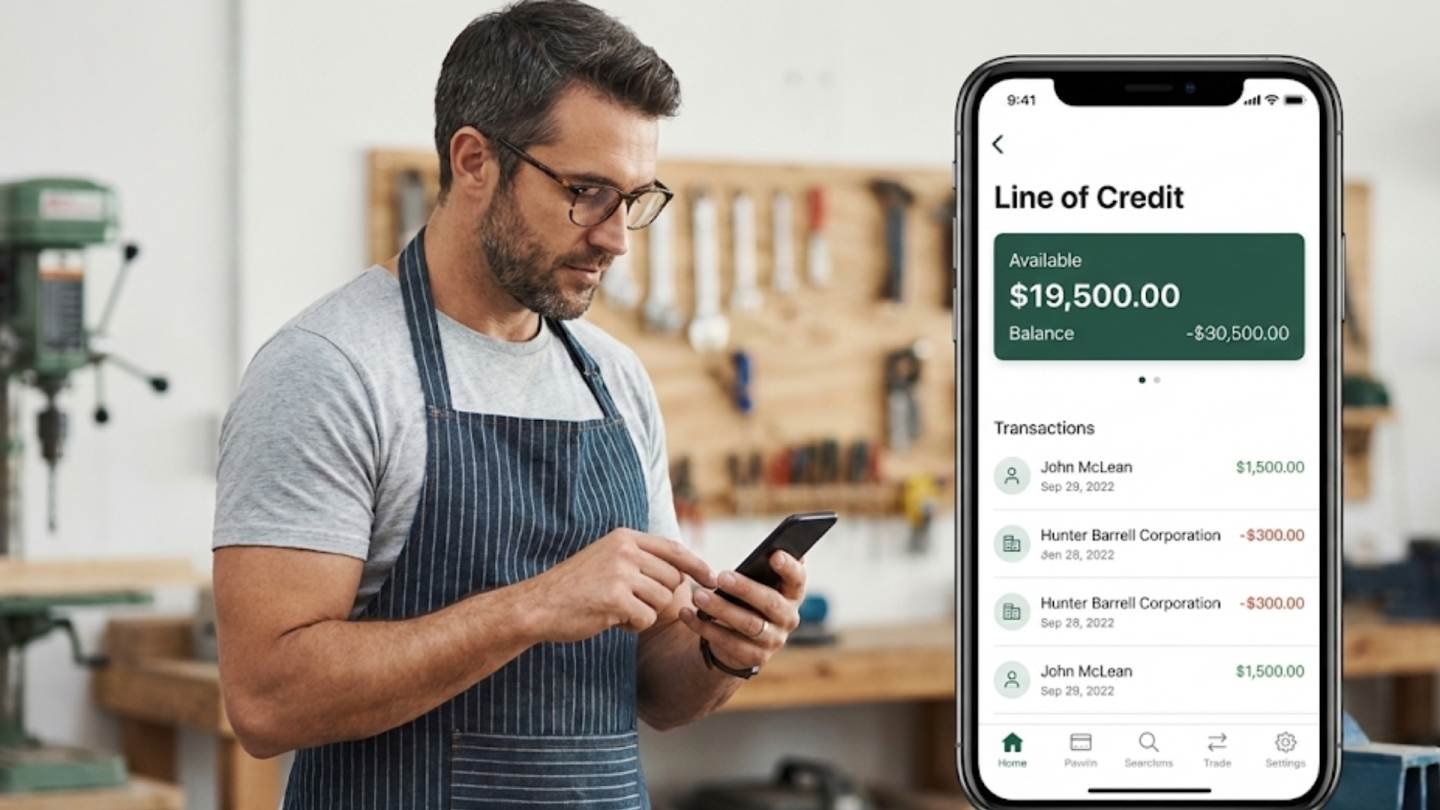

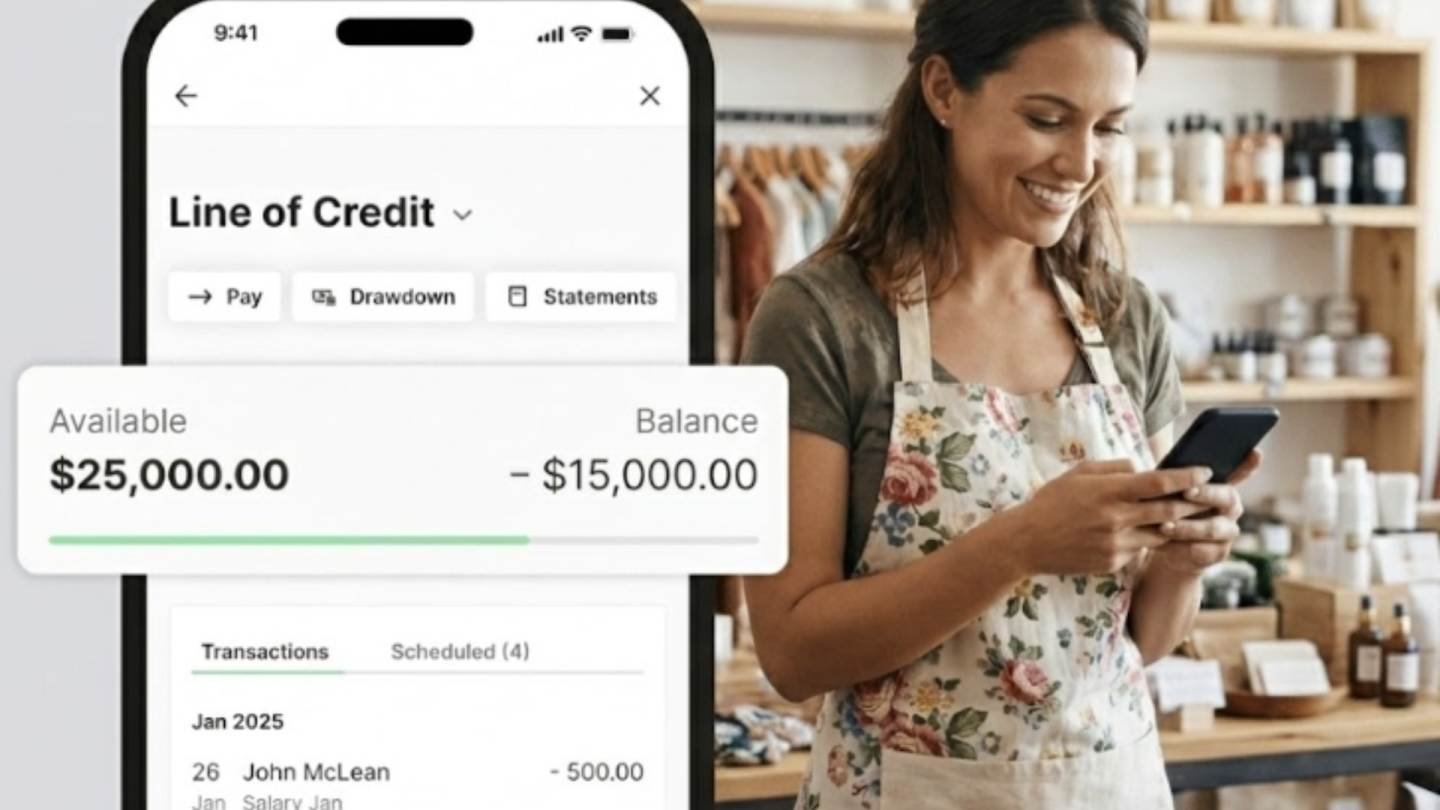

Always Ready: Once approved, you don’t need to re-apply every time you need cash. The funds are there, 24/7, accessible via your online banking or a portal.

Revolving Access: As soon as you repay funds, they become available to borrow again immediately.

Low Doc Options: We work with business line of credit lenders who specialize in low doc business line of credit solutions. This means you can often get approved based on bank statements alone, without needing up-to-date tax returns.

ust like term loans, lines of credit come in two main forms.

Unsecured Line of Credit: Fast approval (often 24 hours) based on your turnover. Ideal for amounts up to $100k – $150k. No property security is required, making it perfect for renters or service businesses.

Business Line of Credit Secured: If you need a larger limit (e.g., $250k – $1M+) or want the absolute lowest interest rate, securing the facility against residential or commercial property is the best path. Because the lender has security, they offer cheaper rates and longer facility terms.

This product is essential for businesses with fluctuating cash flow or seasonal cycles.

The Seasonal Retailer: You need to buy stock in October for the Christmas rush, but won’t see the sales revenue until January. A line of credit bridges this 3-month gap perfectly.

The Tradie: You have huge upfront material costs for a new job but won’t get your progress payment for 30 days. Draw down the funds to buy materials, then pay it back when the client pays you.

The Project Manager: You have unexpected costs—a machine breakdown or an urgent repair. A line of credit acts as an emergency fund, so operations never stop.

The Deal Maker: You see a limited-time discount on bulk inventory. You can snap it up instantly using your line of credit, saving more money on the discount than the interest costs you.

The best time to apply for a line of credit is when you don’t need it. This ensures you aren’t desperate and allows you to shop for the best deal.

Application: Tell us your turnover and desired limit.

Assessment: We compare business line of credit lenders to find the right match. For a low doc application, we simply link your business bank statements digitally.

Approval: You are given a credit limit (e.g., $50,000) and an interest rate.

Activation: The facility is set up. You pay nothing until you make your first withdrawal.

Drawdown: Transfer funds to your transaction account instantly whenever you need them.

We make access simple. To qualify for a standard facility, you typically need:

Active ABN: Registered for GST and trading for at least 6 months.

Turnover: Minimum $10,000 monthly sales (deposited into a business bank account).

Residency: Australian Citizen or Permanent Resident.

Credit: A reasonable credit score (though we have specialist lenders for those with minor credit issues).

Don’t wait for a cash flow crisis to start looking for funds. A Business Line of Credit gives you the peace of mind that capital is always just a click away. Check your eligibility today—it doesn’t impact your credit score, and having the limit in place costs you nothing until you use it.

A Term Loan provides a lump sum of cash upfront (e.g., $50,000) which you pay back over a set period (e.g., 2 years) with regular repayments. You pay interest on the full amount from day one. A Business Line of Credit is revolving. You are given a limit (e.g., $50,000) but you don't have to take the money. You can take $5,000 today, pay it back next week, and take $10,000 next month. You only pay interest on the specific amount you have withdrawn, making it much more flexible for ongoing cash flow management.

It depends on the lender. Some business line of credit lenders charge a small monthly "Line Fee" or "Service Fee" to keep the facility open, regardless of usage. Others charge no monthly fees and only charge interest when you draw down funds. We can help you compare lenders to find a "no usage, no fee" structure if that suits your needs.

Yes. This is known as a low doc business line of credit. Many non-bank lenders and fintechs are happy to approve limits up to $100,000 or even $150,000 based solely on your business bank statements and trading history. They use AI to analyze your cash flow rather than relying on outdated tax returns prepared by your accountant.

It can be either. An unsecured line of credit is faster to set up and requires no property, but usually has a lower limit and slightly higher rate. A business line of credit secured by property (residential or commercial) will grant you a significantly higher limit (potentially $500k+) and a lower interest rate, as the lender has collateral to reduce their risk.

Instantly. Once your facility is set up and active, accessing funds is as simple as logging into a portal or app and transferring the money to your business bank account. The transfer is usually immediate (via Osko/NPP), meaning you can pay an urgent bill while standing in the supplier's office.