Business Finance Australia: Your Path to Fast & Flexible SME Funding

The Right Finance for Every Stage of Your Business

Every ambitious Australian business, from the local trade service to the high-growth tech startup, needs timely capital. Whether you are managing seasonal dips or seizing an expansion opportunity, the right financial structure is crucial. Don’t let cash flow dictate your ambition. We offer a tailored suite of financial products designed to support you at every stage, covering everything from initial Startup Business Loan Funding to scaling your national operation. Ready to explore your options?

Funding for Growth: Small Business Loans & Startups

When growth is the goal, finding flexible, non-dilutive capital is paramount. Our core offering focuses on Small Business Loans Australia, providing the muscle you need for large equipment purchases or significant hiring drives. For established firms, Unsecured Business Loans offer quick access to capital without requiring tangible property as security. For new ventures, our specialized Startup Business Loan Funding options look beyond traditional trading history, focusing instead on the strength of your business plan and personal assets, ensuring you can launch faster.

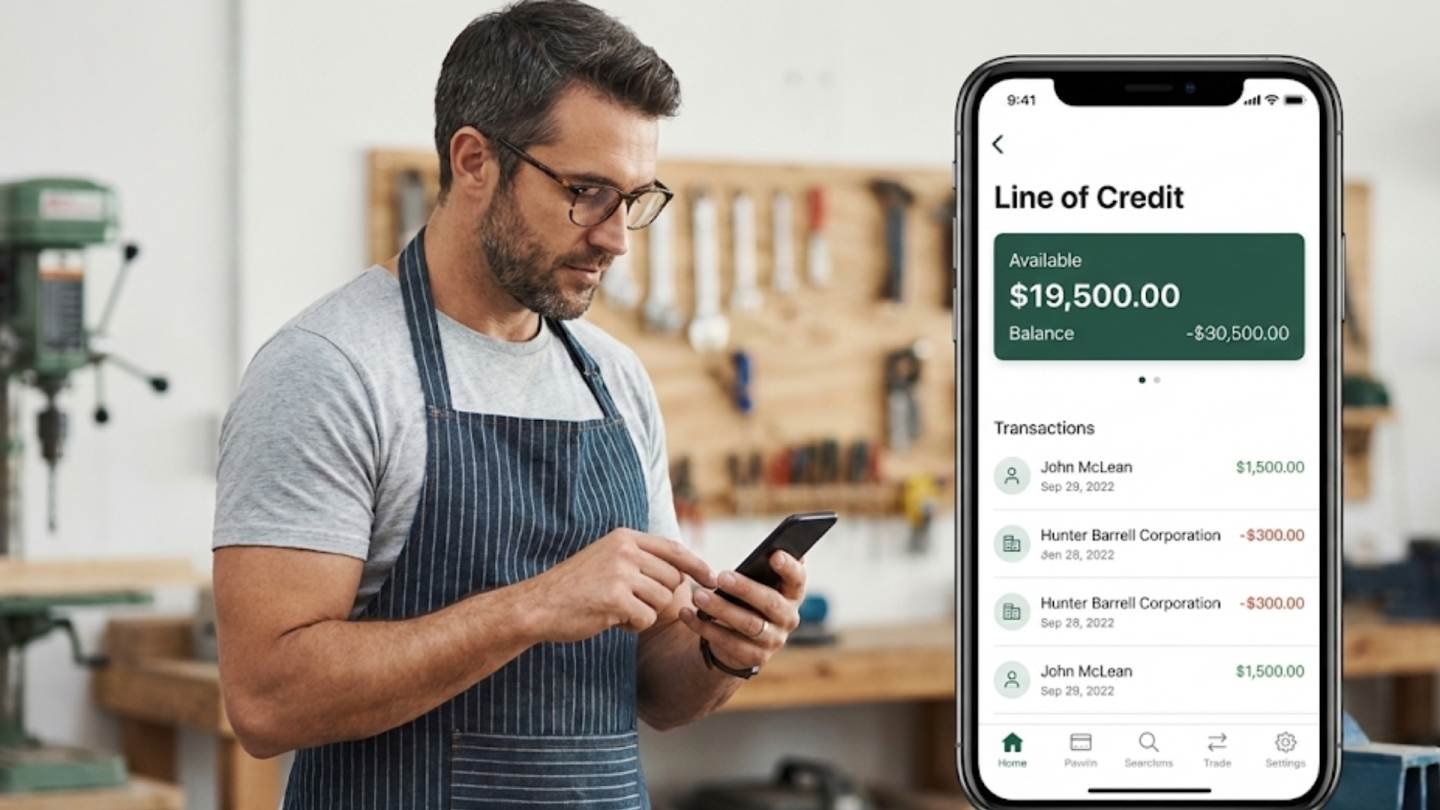

Mastering Cash Flow with Working Capital Solutions

In business, cash flow is king. Our Working Capital solutions are designed to eliminate the anxiety of slow-paying customers or large inventory buys. A Business Line of Credit provides a revolving facility, giving you an immediate safety net you only pay for when you use it. For B2B companies, Invoice Finance Australia (or Debtor Finance Australia) is a powerful tool. Instead of waiting 90 days for client payment, we unlock up to 80% of the invoice value immediately, turning outstanding invoices into instant, reliable cash flow for operations.

Urgent Need? Bridging & Short-Term Finance Explained

Sometimes opportunities—or unforeseen challenges—can’t wait for bank processing times. Our Short Term Business Loans are built for speed, designed to bridge immediate operational gaps, acquire discounted stock, or handle urgent tax obligations. For those with substantial property equity who require rapid, high-value funding, a Caveat Loan Australia provides a reliable, secure solution. By placing a caveat over real estate, we can arrange funding in days, not weeks, helping you secure that time-sensitive deal or tender.

Why Partner with Us for Your Business Finance?

Navigating the finance landscape can be complex, but it doesn’t have to be slow. We operate with a deep understanding of the Australian market and access to over 50 institutional and private lenders. Our expertise ensures you are matched with the product that offers the lowest total cost and the fastest path to funding, solidifying our role as a trusted financial partner, not just a lender. We simplify the entire process from application to settlement.

Ready to Grow? Compare & Apply Today

Stop waiting for bank letters and start focusing on your business. Your success is our priority, and with our streamlined digital process, getting the capital you need has never been faster. Take the first step toward securing your future and accessing the flexible financing your business deserves.

Business Finance

Top 5 Frequently Asked Questions (FAQs)

What is the minimum turnover required for a small business loan in Australia?

Answer: Most mainstream lenders require a minimum of 6 to 12 months in business and an annual turnover starting from $50,000 to $100,000. However, for Startup Business Loan Funding, our specialized private funding options can be more flexible, assessing your capital and business plan rather than just historical turnover. We have solutions tailored to businesses as young as three months.

How quickly can I get approved for a Short Term Business Loan?

Answer: Speed is the core benefit of our Short Term Business Loans. For amounts under $100k, we often provide conditional approval within 2 hours and funding within 24 hours of receiving your signed contract. More complex, secured options like a Caveat Loan Australia can be funded in 1-3 days, significantly faster than traditional bank financing.

What is the difference between an Unsecured Business Loan and a Business Line of Credit?

Answer: An Unsecured Business Loan provides a lump sum that is repaid over a fixed term with regular interest. A Business Line of Credit acts like a flexible business overdraft; you only pay interest on the money you use, and funds become available again as you repay them. The Line of Credit is ideal for managing ongoing Working Capital needs and bridging cash flow gaps.

Is Invoice Finance (Debtor Finance) suitable for a small SME?

Answer: Absolutely. Invoice Finance Australia is perfect for SMEs that issue invoices on payment terms (e.g., 30, 60, 90 days). It immediately unlocks up to 80% of the invoice value, providing instant cash flow. It’s an ideal solution for fast-growing businesses that don't want to take on a traditional loan.

Do you offer business finance for bad credit or low-doc scenarios?

Answer: Yes. While major banks are restrictive, we specialise in finding solutions for non-conforming scenarios. We offer secure options such as a Caveat Loan Australia where the decision is based primarily on your real estate equity, making approval possible even with minor credit blemishes or limited financials (low-doc).